POS / In-Store

Stand-alone. Multi-lane. Complete package including terminal apps.

Multi-Lane payments - IndiGo

iVeri’s IndiGo Multi-Lane solution can be integrated into various existing Till Systems enabling Retailers to have a single view of all transactions (cash and card) across multiple lanes or stores.

- User-friendly integration process - The user-friendly integration ensures minimal disruption to existing systems while maximizing the benefits of a consolidated transaction and inventory management platform.

- Cost Efficiency - IndiGo Cloud allows to significantly cut installation time and minimize ongoing maintenance fees. Our solution empowers businesses to streamline operations with a cost-effective approach, ensuring swift implementation and reduced cost over time.

- Unified Transaction View - The solution provides retailers with a unified and centralized view of all transactions, across multiple lanes or stores.

- Competitive Edge for Acquiring Banks - The comprehensive solution IndiGo offers goes beyond traditional payment processing, providing banks with a powerful tool to attract and retain merchants.

- Operational Efficiency for Multi-Lane Retailers - IndiGo Multi-Lane addresses the retailers need to manage and consolidate data from multiple lanes. By integrating the payment module into the existing Till System, merchants can achieve a more streamlined and efficient process for handling transactions, as well as inventory management.

- Holistic Business Insights - The integration of payment processing into the Till System simplifies the management of multiple systems, granting access to valuable insights into financial transactions and inventory sales, which facilitates decision-making and strategic planning.

- Value Addition for Integrators - For system integrators, the integration of card payments through the IndiGo Multi-Lane solution offers an opportunity to enhance their product offering. It allows them to provide clients with a comprehensive solution that covers both payment processing and transaction management in one integrated package.

- Customization and Scalability - IndiGo Multi-Lane is designed to be customizable and scalable, catering to the unique needs of different retailers. This flexibility ensures that the solution can adapt to evolving business requirements and grow alongside the retailer's operations.

- Security and Compliance - IndiGo places a premium on security. Payments are processed over a secure channel, ensuring the safety of sensitive data. Additionally, the solution helps merchants enhance compliance with industry standards, reducing the likelihood of fraud and ensuring the integrity of financial transactions.

iVeri’s IndiGo Multi-Lane solution can be integrated into various existing Till Systems enabling Retailers to have a single view of all transactions (cash and card) across multiple lanes or stores.

Acquiring Banks

Large Retailers forms an important client base to Acquiring Banks but due to current competition in the market it can be challenging to lock-in these Merchants. With the Indigo integrated solution we provide the Bank with the ability to provide their merchants with a unique product and put them above the rest.

Multi-lane Retailers

Retailers are often faced with the challenge of having a consolidated view of cash/card transactions combined with their inventory sales. Indigo Multi-lane allows Merchants to minimise these challenges by integrating the payment module into the existing Till System allowing a more unified central location of card/cash and inventory management.

Integrators

By integrating card payments, integrators are able to offer an enhanced product which adds value to their current offering and can increase their current client base.

Functionality

- Lower cost Implementation

- Faster Go Live

- Fewer hardware Requirements

- Remote Access

- Data Protection

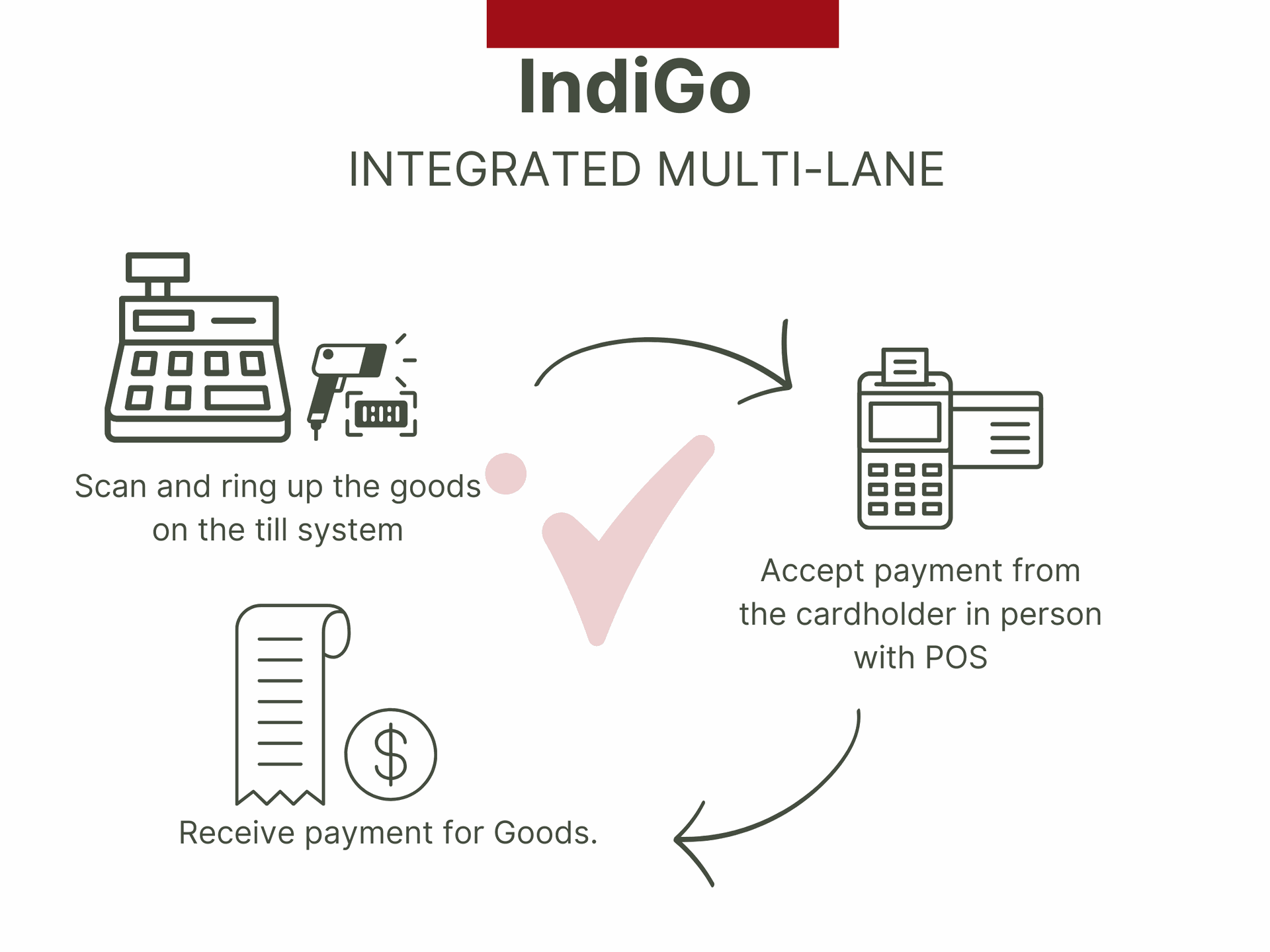

How It Works?

- On checkout, Scan and ring up the goods on the till system.

- Accept payment from the cardholder in person with POS device.

- Once the transaction processing is completed on the iVeri Gateway, Receive payment for Goods.

Contact US

mPress

Tap and Pay

With tap on phone you can accept card payments with just one tap on your Android phone.

What is it?

Tap-on-phone is a new payment feature added to our mPress app that enables businesses to use compatible smartphones to accept cards - minus the cost of the Card Machine.

Lower your Costs - Grow your business - one tap at a time.

Accept payments anywhere, anytime.

No matter where your business takes you, with Tap on Phone you can accept card payments on the go. All you need is your Android smartphone.

mPress App available in the App Store

Android only

Card Payments minus the cost of the Card Machine

With tap on phone you can accept card payments with just one tap on your Android phone.

What is it?

Tap-on-phone is a new payment feature added to our mPress app that enables businesses to use compatible smartphones to accept cards - minus the cost of the Card Machine.

Lower your Costs - Grow your business - one tap at a time.

Accept payments anywhere, anytime.

No matter where your business takes you, with Tap on Phone you can accept card payments on the go. All you need is your Android smartphone.

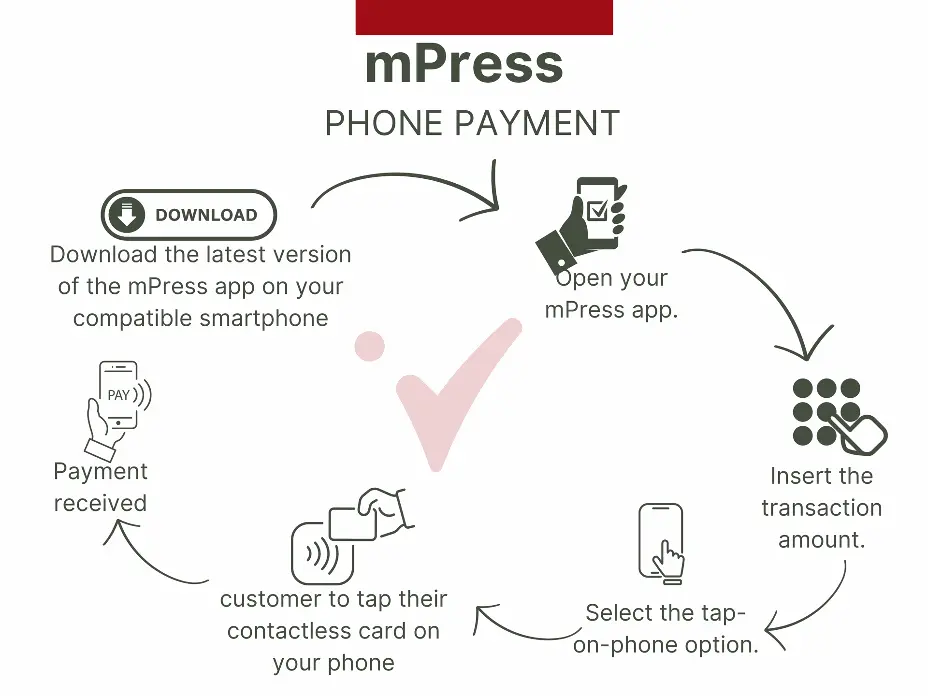

How It Works?

- Download the latest version of the mPress app on your compatible smartphone*:

- Open your mPress app.

- Insert the transaction amount.

- Select the tap-on-phone option.

- Ask your customer to tap their contactless card on the back of your phone, and enter their card PIN when requested to do so.

- And that's it - payment received, and transaction recorded. Securely process card transactions, with no hassle and no fuss.

*Compatible smartphones: Tap on phone works on Google-compatible, NFC enabled smartphones with Android 8.0 or later.

Contact US

Terminals

PoSPort is a card-present solution designed to facilitate secure and efficient card payments in face-to-face environments through a standalone terminal

PosPort is a card-present solution designed to facilitate secure and efficient card payments in face-to-face environments through a standalone terminal. This comprehensive solution not only empowers merchants to seamlessly accept both contact and contactless transactions but also expands the horizon of transaction possibilities, offering a diverse and extended range of transaction sets.

- Quick-to-Market Solution - Experience a faster implementation with PosPort, eliminating the need for integration or complex setup, ensuring your business hits the market faster.

- Automated Remote Software Updates - Enjoy uninterrupted day-to-day business operations as software updates are seamlessly deployed remotely, keeping your terminal up-to-date with the latest features.

- Support of diverse transaction sets - Empower merchants with a diverse array of transaction types, allowing them to cater to various customer preferences, all enabled by their acquiring bank.

- Device Management - Acquirers gain control through a central management portal, enabling updates and customization of transaction types and card acceptance methods on deployed devices, including contactless limits.

- SMYL Loyalty Rewards Program - Enhance customer loyalty and satisfaction with Posport's built-in SMYL loyalty rewards program, a powerful tool that acquiring banks can offer to their merchants.

- Reporting & Monitoring - Access a comprehensive transaction history report, enabling you to gain actionable insights into your payment activities. Effortlessly search and retrieve specific transaction details using our transaction lookup feature.

- Secure Transaction Processing - All transactions are processed securely as data is encrypted both on the device and in transit, ensuring the utmost protection for sensitive information.

Terminals

- Ingenico - Lane 3000.

- Ingenico - Self 2000.

- Ingenico -Self 4000.

- Ingenico - Self 5000.

- Muira M020.

- NewPos - 9220.

- NewPos - 7210.

- NewPos - 6210.

- NewPos - 8210.

- Newland - N700.

- Newland - N750.

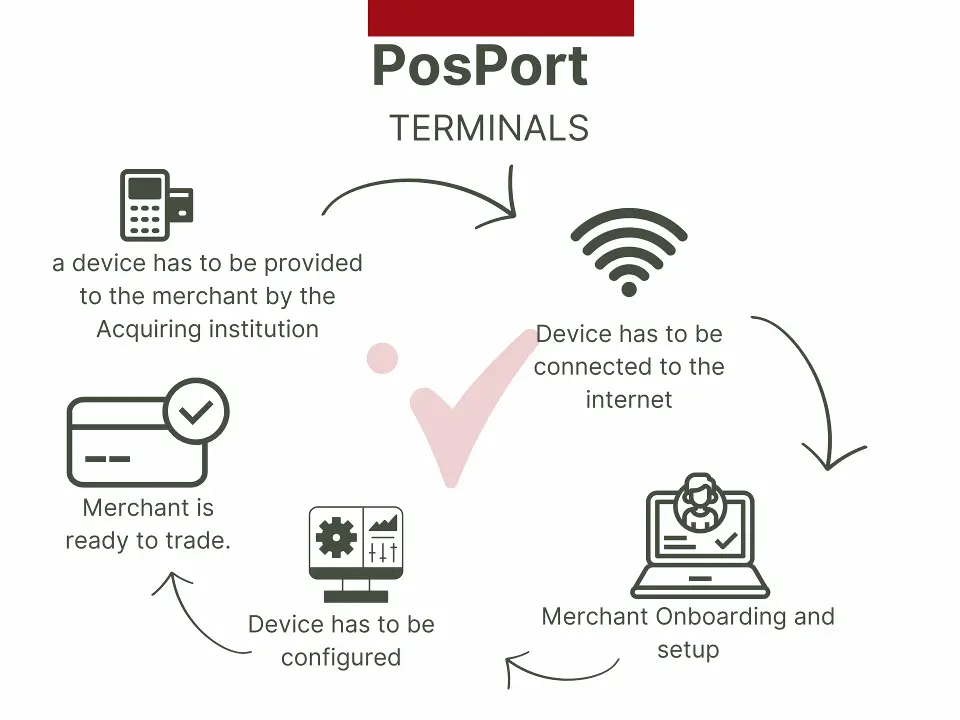

How It Works?

- Device: a device has to be provided to the merchant by the Acquiring institution

- Connectivity: Device has to be connected to the internet

- Merchant Setup: Merchant Onboarding

- Device Config: Device has to be configured on the Acquirer PosPort system and a config is to be done on the device to allow connecting to the PosPort system as well.

- Merchant ready to trade

Contact US

Indigo Opera

As an Oracle payment gateway partner, iVeri’s integration with OPI (Oracle Payment Interface) is designed to enhance Pay-at-Reception customers’ experience on OPERA

As an Oracle payment gateway partner, iVeri’s integration with OPI (Oracle Payment Interface) is designed to enhance Pay-at-Reception customers’ experience on OPERA. With OPERA Cloud or OPERA On-Premise (v.5), merchants can effortlessly manage reservations and accept card present payments.

This powerful solution streamlines the check-in and check-out process by enabling secure and efficient card payment processing.

Payment types supported by iVeri for Pay at Reception:

- Authorisation ,

- Incremental authorisation ,

- Refund,

- Settlement,

- Void,

- Purchase(sale)

- Simplifying PCI DSS Compliance - OPERA OPI places a premium on Compliance. Payments are processed over a secure channel, safeguarding sensitive data as it travels from the OPERA reservation platform to the iVeri payment Gateway. This not only strengthens transaction security but also assists hotels in reducing their PCI DSS scope.

- Unified Transaction View - This solution offers hotels a centralized overview of all transactions across workstations, streamlining the reconciliation process between payments and reservations..

- Enhanced Security to Protect Merchants from Chargeback Risks - Merchants are safeguarded against chargeback risks due to the secure transaction process that requires cardholders to present their card and authenticate payments

- Reporting & Monitoring via BackOffice - With access to a comprehensive transaction history report, hotels can gain actionable insights into their payment activities, and effortlessly search and retrieve specific transaction details using the transaction lookup feature.

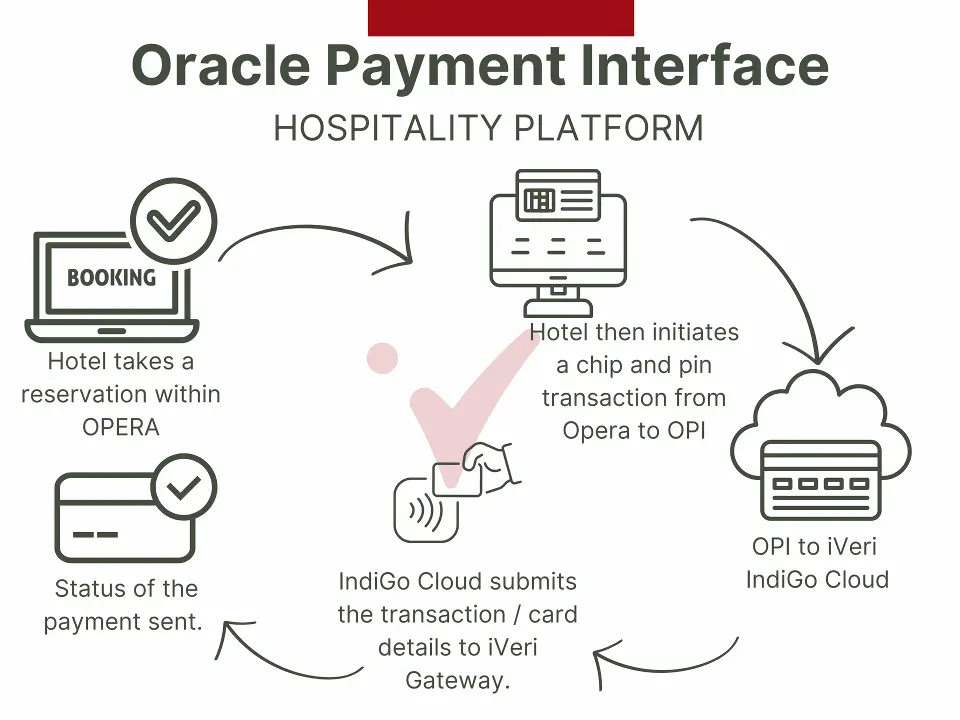

How It Works?

- Hotel takes a reservation within OPERA

- Hotel then initiates a chip and pin transaction from Opera to OPI

- OPI to iVeri IndiGo Cloud (IndiGo cloud prompts the guest to insert or tap/dip their card on the device)

- IndiGo Cloud submits the transaction / card details to iVeri Gateway.

- iVeri Gateway to the Bank for Authorisation.

Contact US

Card Associations

Pay in every way.